Getting started with Onfido

Start here

This introductory guide offers an overview of Onfido’s Real Identity Platform, our end-to-end identity verification solution that enables you to smoothly and securely onboard customers and grant them access to your services.

This guide is designed to get you up to speed on all of our products and features so that you can start building your verification journeys as quickly as possible. Here you’ll find:

- a brief overview of Onfido’s suite of identity verification signals

- an introduction to Onfido Studio, our orchestration solution for building, managing and deploying identity verification flows

- an overview of the Onfido API

- an introduction to our Smart Capture SDKs

- a glossary of key terms

If you’re already familiar with these concepts, you can begin your integration straight away by following our Get started integrating guide.

Onfido's Verification Suite

Onfido's Real Identity Platform offers a comprehensive suite of identity verification products. These include:

Document and biometric verifications

| Report | Description |

|---|---|

| Document report | A Document report verifies if an identity document uploaded by an applicant is genuine. It is composed of data integrity, visual authenticity and police record checks, which verify the document's internal and external consistency to identify potential discrepancies. |

| Facial Similarity report | A Facial Similarity report compares a selfie or video provided by an applicant to the photo in the most recent identity document they have provided. It aims to prove identity document ownership. Onfido offers four types of Facial Similarity report: Photo, Photo Fully Auto, Video and Motion. |

| Known Faces report | The Known Faces report compares a specific applicant’s likeness in their most recently captured media (a live photo, live video or motion capture) to media from previous applicants in your Onfido account database. The report alerts you to faces which have already been through your identity verification flow, highlighting potential repeat identity fraud attempts, or identifying users who may have forgotten they already registered with you, in order to help them recover their accounts. |

| Near Field Communication (NFC) | Onfido supports NFC data extraction from documents such as ePassports to verify document and biometric data as part of a Document report. |

Trusted data source verifications

| Report | Description |

|---|---|

| Identity Enhanced | An Identity Enhanced report validates an applicant’s identity by cross-referencing their details against a range of verified databases. It is typically used for Know Your Customer (KYC) purposes. |

| Watchlist | A Watchlist report allows you to verify a user's records on global watchlists, including Sanctions, Politically Exposed Persons (PEP), Monitored Lists, and Adverse Media. |

| Proof of Address | A Proof of Address (PoA) report validates an applicant's address using supported UK PoA documents uploaded by the applicant. (This report can only process UK PoA documents, unless you are using API v3.3 or later). |

| Driver's License Data Verification (DLDV) | A DLDV report verifies the authenticity of an end user's document by comparing it against US state driver's license databases to confirm whether the data submitted corresponds to a real driver's license. This allows quick and accurate verification that a given driver's license is real, providing a strong signal against synthetic fraud. (This report is only available for US documents). |

Fraud detection signals

| Report | Description |

|---|---|

| Device Intelligence report | A Device Intelligence report assesses non-document and non-biometric signals to capture sophisticated fraud, without any additional user friction. The report captures digital, passive fraud signals of device integrity, IP and geolocation data. |

| Repeat Attempts | The Repeat Attempts product compares the identity document from your Document report to other onboarded documents in your Onfido database. It protects against cases where the same document is used repeatedly with minor modifications, indicating potential fraud. |

For more in-depth documentation about any of these reports, please refer to our product guides.

Onfido Studio

All of the verification signals described above can be built into sophisticated identity verification flows using Onfido Studio, our orchestration solution to manage the capture, upload and verification of user data, all in one simple, drag-and-drop interface.

Managing and deploying identity verification journeys with Onfido Studio offers a range of benefits, including:

- automated, smart decision making through no-code workflows

- customized and flexible user verification journeys

- scalability to new markets and user requirements

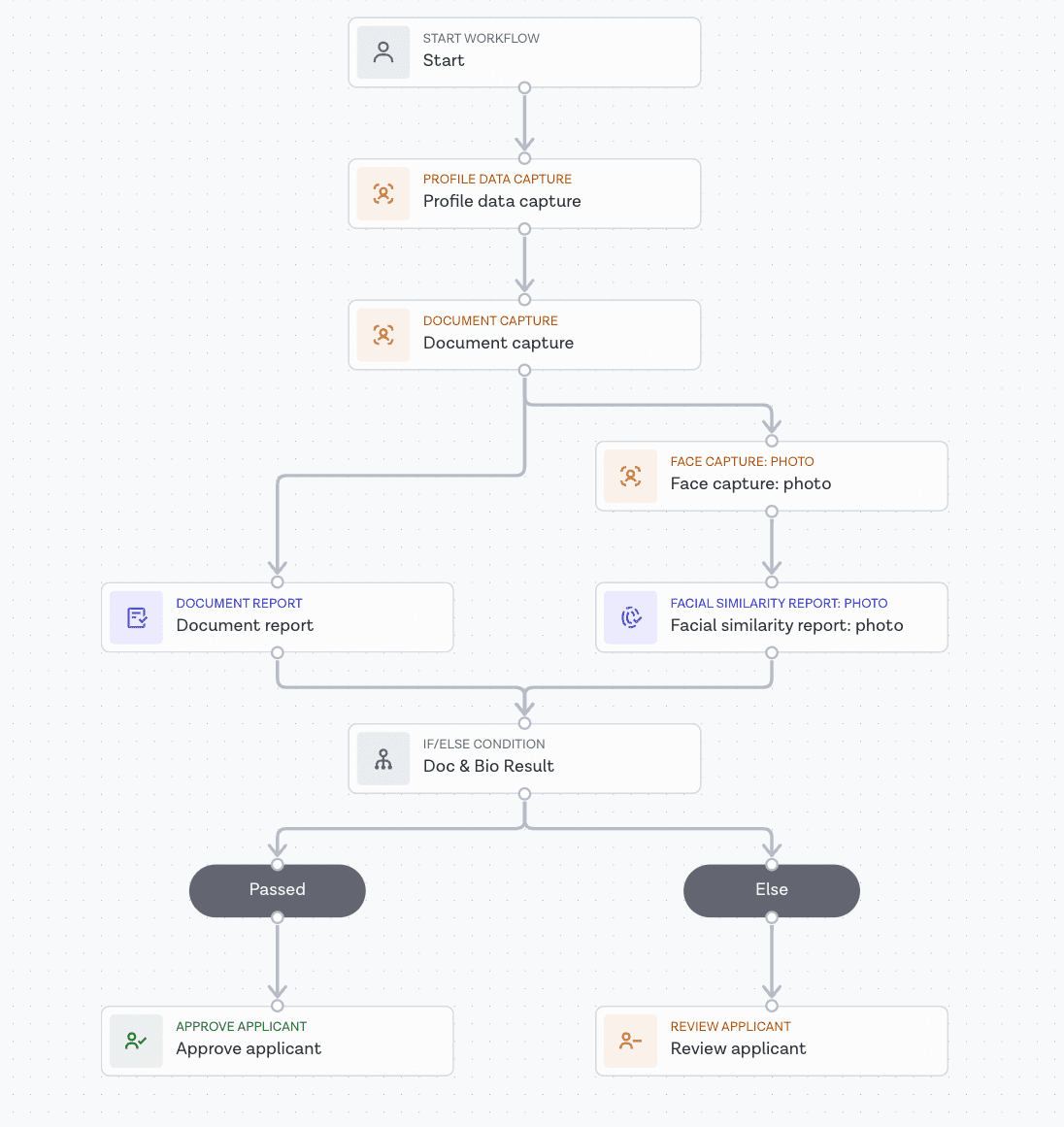

Below you will find an example of a simple Studio workflow:

Onfido Studio works best in conjunction with our Smart Capture SDKs (detailed in the section below), which communicate directly and dynamically with active Studio workflows to create a seamless customized end-user experience.

Alternatively, Studio also powers Smart Capture Link, a fully customizable low- to no-code frontend solution hosted by Onfido, allowing you to verify individuals with little to no engineering effort or integration with our SDKs.

To find out more about Studio or Smart Capture Link, please refer to our Onfido Studio product guide.

Onfido API

The Onfido API allows you to manage and interact with Studio workflows and verification checks programmatically, and is based on REST principles. It uses standard HTTP response codes and verbs, and token-based authentication.

The API can be used to generate SDK tokens, create applicants, create and retrieve Studio workflow runs and much more.

In order to make use of Onfido Studio, you must be using API v3.4 or later. We recommend you use the most recent possible version when integrating or making integration changes.

Smart Capture SDKs

Onfido’s Smart Capture SDKs are a set of Software Development Kits that provide a secure and accessible document and face capture flow for your apps. They are optimized to help you successfully verify users in a way that is both secure and compliant.

Onfido SDKs are available for iOS, Android, Web, React Native and Flutter. They provide a drop-in set of screens and tools for mobile applications, as well as components for JavaScript applications. These allow your app to capture documents, selfies, live videos and motion captures for identity verification.

Onfido’s primary integration path is with Onfido Studio, working in conjunction with our Smart Capture SDKs, to offer your customers the best possible onboarding and identity verification experience. Benefits of SDK integration include:

- carefully designed UI to guide your customers through the entire photo and video-capture process

- modular design to help you seamlessly integrate the photo and video-capture process into your application flow

- advanced image quality detection technology to ensure the quality of the captured images meets the requirement of the Onfido identity verification process, guaranteeing the best success rate

- direct image upload to the Onfido service, to be verified in your Studio workflow

Glossary of key terms

Below you will find a number of key terms that you’ll need to be familiar with when integrating Onfido.

Applicant

An applicant is the representation of an end user, your customer.

An applicant is the individual who will be the subject of a verification check. Creating an applicant is the first step towards initiating a check. Without an applicant, a check cannot be completed. Applicants should map one-to-one with your customers.

Required applicant data differs depending on the report type within a check.

Report

A report is a single verification request, such as a Document report or Facial Similarity Photo report.

There are a number of different report types. Depending on the type of verification you wish to perform, different information will need to be provided or collected within the workflow.

For example, to complete a verification on an applicant with only a Document report, a document will be required, whereas to complete a verification with both a Document report and a Facial Similarity Photo report, a document and a live photo will be required.

Document

A document is the upload of a required document provided by an applicant, such as a passport, national identity card or driving license. The type of document required depends on the individual reports which make up the check.

You can review our full list of supported documents here.

Workflow

Workflows are dynamic end-user verification journeys that are defined using Onfido Studio’s simple, drag-and-drop interface, the Workflow Builder. Workflows are made up of interactive and non-interactive tasks to manage the capture, upload and verification of user data.

Workflow run

Workflow runs are individual instances of a workflow to be run against a given applicant. Creating a workflow run with the Onfido API using the id of a valid and active workflow will begin the end-user verification journey for a designated applicant.

Live photo

A live photo is an image of the applicant’s face, taken in real-time during a verification check.

A live photo is required in order to perform a Facial Similarity Photo report on the applicant.

A live photo is typically taken by an applicant at the same time as documents are provided.

Motion capture

A motion capture is footage of the applicant’s face, recorded and uploaded by the Onfido SDKs.

A motion capture is used to perform a Facial Similarity Motion report on the applicant. During the motion capture, end users are asked to perform a simple head turn pattern in both directions.

A motion capture is typically taken by an applicant at the same time as documents are provided.