India Tax ID report

Start here

This guide presents a technical overview of Onfido's India Tax ID report.

Introduction

The India Tax ID report validates an end user's Indian Permanent Account Number (PAN) by matching it to official records held by the Indian government.

Onfido uses a third-party subprocessor to match the provided PAN and full name against the central Indian government database. This allows fast, low friction and accurate PAN verification, providing enhanced protection against fraud and helping businesses confidently achieve regulatory compliance.

Result logic

The India Tax ID report can return a result of clear or consider:

The overall report result will be clear if the applicant's PAN is valid and their full name matches the name stored in the database.

The overall report result will be consider if the applicant's PAN is invalid or their full name doesn't match the name stored in the database.

More details regarding the structure of the report and an example result can be found in our API reference documentation.

India Tax ID Report task

Similar to other Onfido reports, to run an India Tax ID report, the dedicated India Tax ID Report task should be added to a Studio workflow from the Workflow Builder.

Input data for this task can be received from the workflow input data or a dedicated Profile Data Capture task. Note that the applicant's first name, last name and PAN are mandatory for running this report.

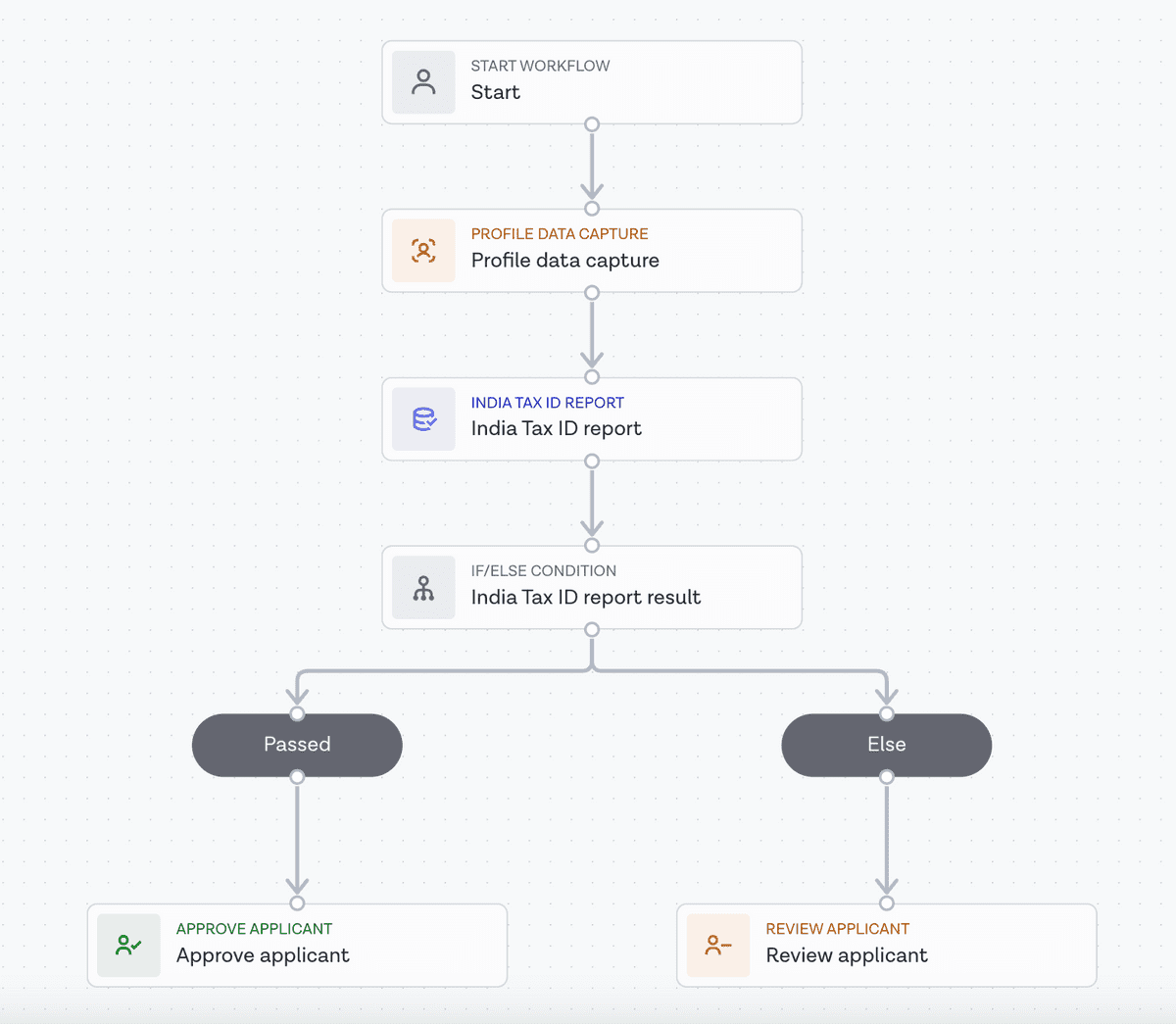

Below you will find an illustrated example of a Studio workflow running a India Tax ID report:

More information about report tasks can be found in our Studio Product Guide.

India Tax ID Report task results

If you wish to obtain the specific outputs from the India Tax ID Report Task via the Onfido API (for example, the overall report result or breakdown results), you can manage this by configuring the Workflow Output in the Studio Workflow Builder. You can also retrieve all associated output data from an India Tax ID Report.

You can refer to our Studio product guide for more information on Workflow Output configuration. Once set up, the output can be consumed by making a Retrieve Workflow Run call to the Onfido API. Report results are found in the output property.

Workflow Run results can also be accessed on the results tab of your Studio Dashboard.